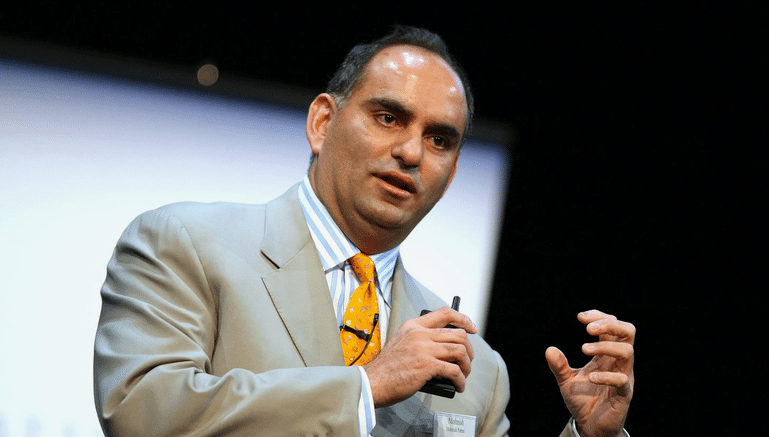

kepotimes.com – Mohnish Pabrai, the founder and managing partner of Pabrai Investment Funds, has built an extraordinary reputation in the world of investing.

With over $1 billion in assets under management, Pabrai is recognized for his disciplined approach to value investing, drawing heavily from the strategies of legendary investors Warren Buffett and Charlie Munger.

His journey, which began with just $1 million, has turned into a masterclass in patience, discipline, and the art of compounding.

The Power of Cloning Investment Strategies

Pabrai describes himself as a “shameless cloner,” openly admitting that much of his success stems from emulating the investing wisdom of Buffett and Munger.

Rather than reinventing the wheel, Pabrai carefully studies successful strategies and adapts them to his own portfolio.

This approach, while simple in theory, requires a deep understanding of markets, companies, and the importance of value investing buying stocks at prices well below their intrinsic value.

By adopting this mindset, he has managed to grow his portfolio while avoiding unnecessary risks.

Value Investing and the Magic of Compounding

At the heart of Mohnish Pabrai strategy is the concept of compounding—letting investments grow over time. Instead of chasing short-term gains, Pabrai advocates for holding onto investments that can multiply in value over the years.

He famously discusses how small changes in an investor’s approach, like reducing fees or focusing on high-quality businesses, can significantly impact long-term returns.

His portfolio a hallmark of the value investing philosophy, allowing him to benefit from the compounding effect over decades.

What Pabrai Looks for in an Investment

Pabrai’s investment philosophy is simple but effective. He looks for companies with strong fundamentals, a competitive edge, and management that is aligned with shareholders’ interests.

Additionally, he seeks out investments that offer a “margin of safety”—the idea of buying stocks at a price significantly lower than their estimated worth to reduce the risk of loss.

This approach has led him to make bold bets, such as investing in companies during times of distress or when they are temporarily out of favor with the market. By being patient and having the conviction to hold onto these investments, Pabrai has been able to turn them into significant winners.

Lessons from Mohnish Pabrai’s Investing Masterclass

For anyone looking to emulate Pabrai’s success, the key takeaways are clear: patience, discipline, and focus are critical to long-term investing success. He has shown that by following a value-based strategy, investing doesn’t need to be overly complex. Instead, it requires an understanding of businesses, a willingness to learn from others, and the patience to let investments compound over time.

Conclusion

Mohnish Pabrai’s journey from $1 million in assets is a testament to the power of value investing and disciplined strategy. By following the footsteps of greats like Warren Buffett and Charlie Munger, has created a blueprint for success that any investor can learn from. His approach is a reminder that success in the investing world isn’t about being the smartest it’s about being the most disciplined and patient.