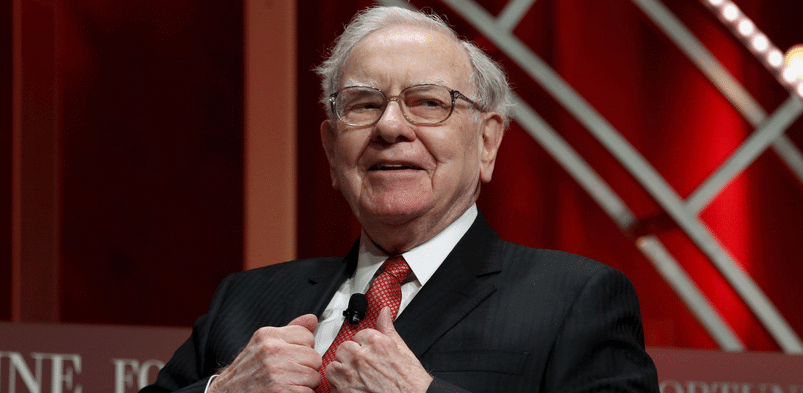

kepotimes.com – Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has recently made a significant move in the investment world by selling $100 billion worth of stock.

This massive sale has surprised analysts and market participants alike, given Buffett’s reputation for holding stocks over the long term.

The large-scale sale has sparked speculation about Buffett’s outlook on the market and the global economy.

Why Did Buffett Sell Such a Large Amount of Stock?

Warren Buffett, Many are questioning the reasons behind Buffett’s decision. Although he is known for his conservative, value-based investing approach, selling such a substantial amount of stock sends a strong signal.

Analysts speculate Hathaway for a potential market correction or looking for more attractive investment opportunities in the future.

On several occasions, Buffett has expressed concerns about stock valuations being overly inflated.

With rising interest rates and global economic uncertainty, this might be the right time for Buffett to liquidate a significant portion of his portfolio.

Impact on Global Markets

The $100 billion stock sale not only affects Berkshire Hathaway but also influences global market sentiment.

Investors around the world are beginning to question whether this move signals something larger—possibly an economic slowdown or a major stock market correction.

The stocks that Buffett sold have come under pressure, while other market players are cautiously following suit.

Long-Term Strategy or Tactical Move?

Despite the size of this sale, it’s unclear whether this is part of Buffett’s long-term strategy or just a tactical move to take advantage of current market conditions.

Buffett is known for his unwavering optimism about the U.S. stock market. However, this large-scale sale raises speculation that he may be seeing warning signs that others have yet to recognize.

For investors, this moment calls for reflection on their own strategies. Should they follow Buffett’s lead or maintain confidence in their existing portfolios?

Warren Buffett’s decision to sell $100 billion worth of stock is not a typical move. It is a significant event that could potentially reshape the direction of global markets.